The Housing and Community Development Down Payment Assistance Program (DAP) can provide financial assistance to help you purchase your dream home in Harris County.

Applicant Eligibility Criteria

- First-time homebuyer that has not owned a home for three years prior to applying for assistance

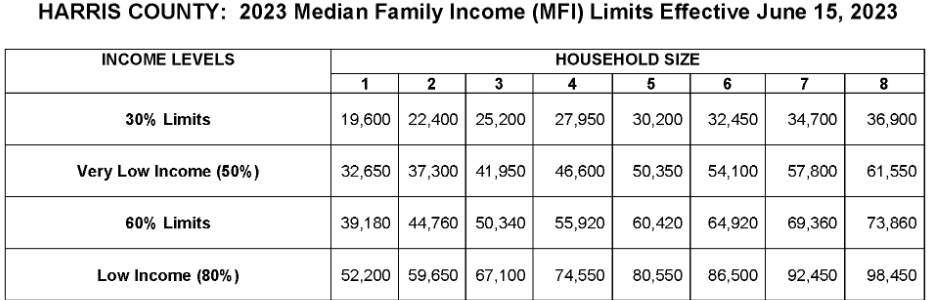

- Buyer is income qualified (see chart below).

- Buyer must have at least one credit score of 580.

- Buyer must be credit approved through one of the participating mortgage lenders .

- Buyer front-end ratio (debt) cannot exceed 39% and the back-end ratio or Debt-to-Income ratio (DTI) cannot exceed 42%.

- Buyer is required to successfully complete an 8-hour homeownership education course before applying for DAP assistance. Course must be:

o provided by a HUD approved homebuyer education course provider.

o performed by a Certified Counselor

o and buyer is required to submit a final signed household budget from their HUD approved provider.

- Buyer must contribute a minimum of $1000 towards the purchase of the home.

- Buyer cannot have more than $15,000 in liquid assets, such as stocks, cash, or bonds.

- Borrower(s) and/or Non-Participating Spouse are required to be a U.S. Citizen or Permanent Resident Alien.

Total family gross income cannot exceed the following: